This week our guest blogger is from Expeditors Cargo Insurance Brokers (ECIB). ECIB provides supply chain risk management solutions tailored to the specific needs of its clients, leveraging its background in logistics and hands-on approach to claim subrogation to provide access to lower rates and broader insurance coverage. ECIB is a wholly owned subsidiary of Expeditors International of Washington, Inc. It is headquartered in Seattle, Washington, with employees located throughout the U.S., Mexico, Europe, Australia, and the Middle East.

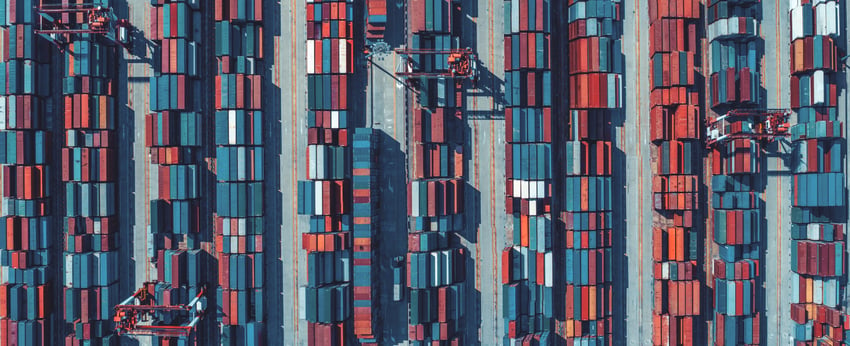

A supply chain can be a complex network of shifting variables, each impacted by events outside of your control. While standard cargo insurance can alleviate the burden of some physical damage or loss, certain trade disruptions can have a greater financial impact on your organization.

A widespread public health issue can lead to significant delays in international trade and serve as a reminder to expect the unexpected when managing your organization’s supply chain. A reliable way to protect your organization is with Trade Disruption Insurance (TDI). While (generally speaking) cargo insurance covers the value of goods in transit when damaged, stolen, or missing, it does not cover the financial impact from lost revenue due to delay or interruption of the supply chain that can occur during a public health crisis. Some examples of items covered by TDI include lost profits, unanticipated expenses, temporary locations, and labor re-education.

Infectious disease policies are a type of trade disruption coverage that is designed specifically to protect companies from the financial impact and additional expenses incurred as a result of an outbreak-driven interruption. Coverage triggers and conditions may vary from policy to policy. For example, the insurer may require that the World Health Organization declare a “Public Health Emergency of International Concern.” Other insurers may require a qualifying number of confirmed fatalities caused by a covered disease within the country or neighboring countries within a certain time frame.

Regardless of the defined trigger, there must be a corresponding loss of income as a result of an interruption. If these conditions are met, businesses can (again, generally speaking) expect to be reimbursed for a pre-negotiated period following the notification, reducing risk and mitigating unexpected financial loss.

Effective TDI is proactive and flexible, as it pertains to an infectious disease policy or otherwise. As with supply chain complexities, coverages may vary from one company to another. Each policy must be individually constructed to provide a company with risk-specific coverage, protecting it from the particular hazards it faces in its own field of business.

With an in-depth knowledge of transportation, logistics, and supply chain insurance solutions, ECIB specializes in structuring the broadest insurance programs for your organization. Reach out to ECIB to find out more about how Trade Disruption Insurance can protect your business.

Please note: While TDI is unavailable for COVID-19, companies may consider TDI for future risk mitigation strategies.