This week our guest blogger is from Expeditors Cargo Insurance Brokers (ECIB). ECIB provides supply chain risk management solutions tailored to the specific needs of its clients, leveraging its background in logistics and hands-on approach to claim subrogation to provide access to lower rates and broader insurance coverage. ECIB is a wholly owned subsidiary of Expeditors International of Washington, Inc. It is headquartered in Seattle, Washington, with employees located throughout the U.S., Mexico, Europe, Australia, and the Middle East.

When most logistics managers think of cargo claims, they have money on the mind. Specifically, the money they can recover from the carrier who was liable for damaging or losing their cargo. It is true, the most obvious reason to have a cargo claims program is to recover from the responsible carrier some of the money lost due to product being damaged or going missing during transit. However, those individual recoveries are really just one piece of the pie – and potentially, a small piece compared with the value that claims data can bring to an organization.

Filing claims and recovering liability dollars can help defray loss or damage costs, but claims by themselves are a piecemeal solution. Each claim by itself is anecdotal: it does not help you see how much your organization is losing to claims per year, what products tend to be damaged the most, or what carriers are most often responsible for the damages and losses. These tend to be real pain points in an organization’s supply chain, and they can have a big impact on the bottom line.

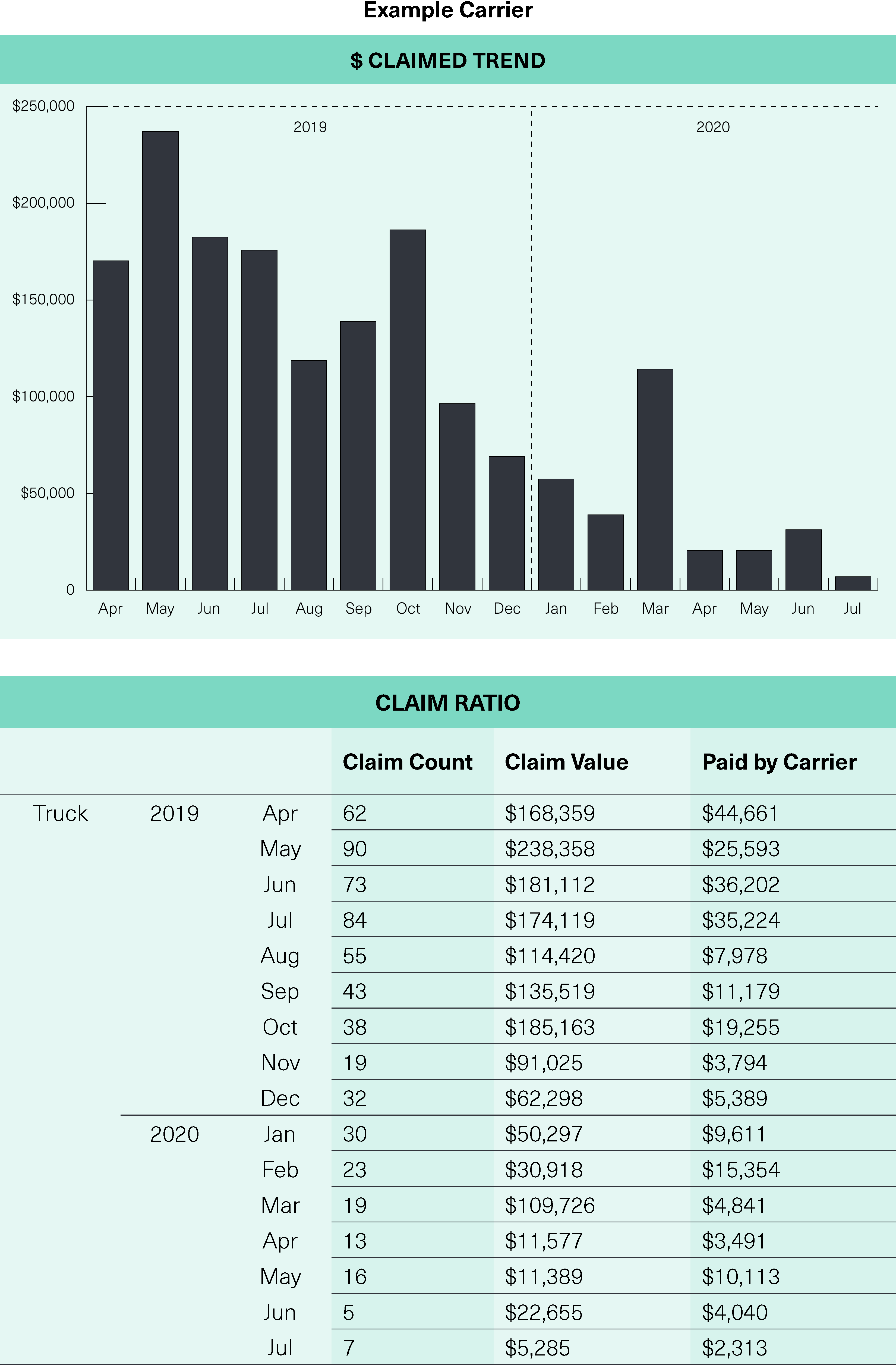

ECIB’s Claims Management programs not only increase monetary carrier recoveries, they also, more importantly, offer the ability to see the “Big Picture”. This is done by using tracked data to highlight actionable improvement opportunities throughout the supply chain. Shipment and item level information such as ship date, shipper, consignee, claim date, and bill of lading details are just some of the information used to provide valuable insights. Insights such as which locations are reporting the most claims, and which are not reporting any. Which products get damaged the most, and on which transit lanes? How do the various carriers perform against one-another when it comes to claims ratio, and what are the leading causes of claim denials? All of these insights provide a clear and objective picture of pain points in a supply chain. A picture which will help decision making when it comes to improvements such as shipping/receiving dock training, carrier or lane selection, and packaging enhancements, to name a few.

In addition, ECIB’s Claims Management solution offers the ability to calculate a true “claim ratio”. Claim data is useful, but can be even more powerful when combined with shipment data. This allows claim count to be considered against shipment volume, expressed as a single percentage number that can be compared across carriers with different volumes of an organization’s freight spend. The claim ratio is a key performance indicator that can help an organization not only dial in their logistics operations, but also maximize their risk management portfolios.

Never before has claims data looked so appealing. While recovering money for damaged cargo can lessen the financial impact of a claim, a more prudent approach is to mitigate the loss factors and improve operational efficiency altogether. ECIB is here to help, every step of the way. Reach out to our experts today to learn more about the benefits of claims data and analytics.

The Claim Ratio – a powerful and actionable KPI that helps identify trends when it comes to freight damages and losses: Dashboards and scorecards using this data can be a powerful tool for carrier business reviews.