Welcome to Onyx Strategic Insights’ 2026 outlook, where we examine the forces shaping the global economy and supply chains in the year ahead. This analysis highlights macroeconomic trends, geopolitical risks, and structural policy shifts that will influence business strategies worldwide. Onyx Strategic Insights is a division of Expeditors that helps companies build strategy and manage risk through the lens of geopolitics and macroeconomics.

Download the 2026 outlook here, to read our coverage in detail.

Our global outlook in a nutshell:

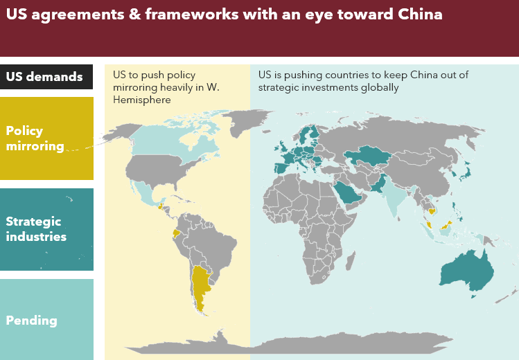

- Persistent policy disruptions. The consequences of 2025 are in full swing, forcing countries to react to a rapidly changing environment and confront the realities of their strategic positioning. Meanwhile, powerful countries turn to extraterritorial trade actions to gain leverage in the international system. Companies will be caught in these substantive policy shifts.

- Slower growth, higher uncertainty. Economic growth remains subdued as the US attempts to shift away from its consumer-led macroeconomic model, while protectionism rises and capacity is increasingly duplicated.

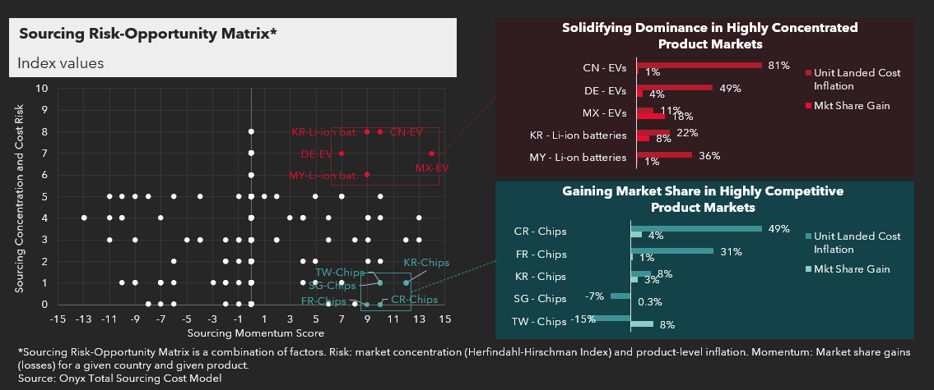

- Mixed picture of risk & opportunity. Shifts in market opportunities are highly sector specific as operational realities and policy decisions interact, resulting in new opportunities in key segments. Capacity will remain constrained however and investment in greenfield projects is likely to remain muted throughout this year.

- Supply chain reconfiguration. Companies are accelerating diversification strategies, with nearshoring and friend-shoring, consolidation, and other adaptations gaining momentum as geopolitical tensions increase cost and reshape trade flows.

- Geopolitical flashpoints. Regional conflicts and strategic rivalries persist and expand in 2026, amplifying risks for global operations. As the US turns its immediate focus to Latin America and as the Red Sea crisis begins to calm, Onyx looks at the current escalation pathways.

What it means:

2026 is a year of strategic recalibration globally. Companies must plan for volatility as the systemic disruption continues, and the gradual realignment of the global system plays out. For companies, the disruption will continue to drive costs higher, make risks more acute, and hinder strategic decisions.

- Policy forecasting and regulatory monitoring have become increasingly crucial tools for teams navigating the disruption.

- Risk management moves to the forefront. Scenario planning, quantitative analysis, and mitigation planning are essential to reduce exposure to geopolitical and economic shocks.

Adaptability is the defining advantage in 2026. Businesses that anticipate interconnected risks and act decisively will be better positioned to thrive in an era of persistent uncertainty. Stay prepared by reading the full 2026 Outlook blog from Onyx or visit their website using the banner below.